Turning your passion for cake-making into a business is an exciting journey that can bring great rewards. With the right guidance, setting up a registered cake business in Australia can be a straightforward process.. Understanding the legal and licensing requirements for starting a cake business is an important step in building a successful and compliant business in Australia. With the right information, this process can be clear and manageable.

At CakerHQ, we know how overwhelming it may become if you don’t know all the details. For this exact reason, let’s shift from our traditional topics and talk about it. We’ll overview the choice of business structure, how to register it, and how to make sure your business complies with all the rules in Australia. Let’s begin with the basics.

Business structure and registration

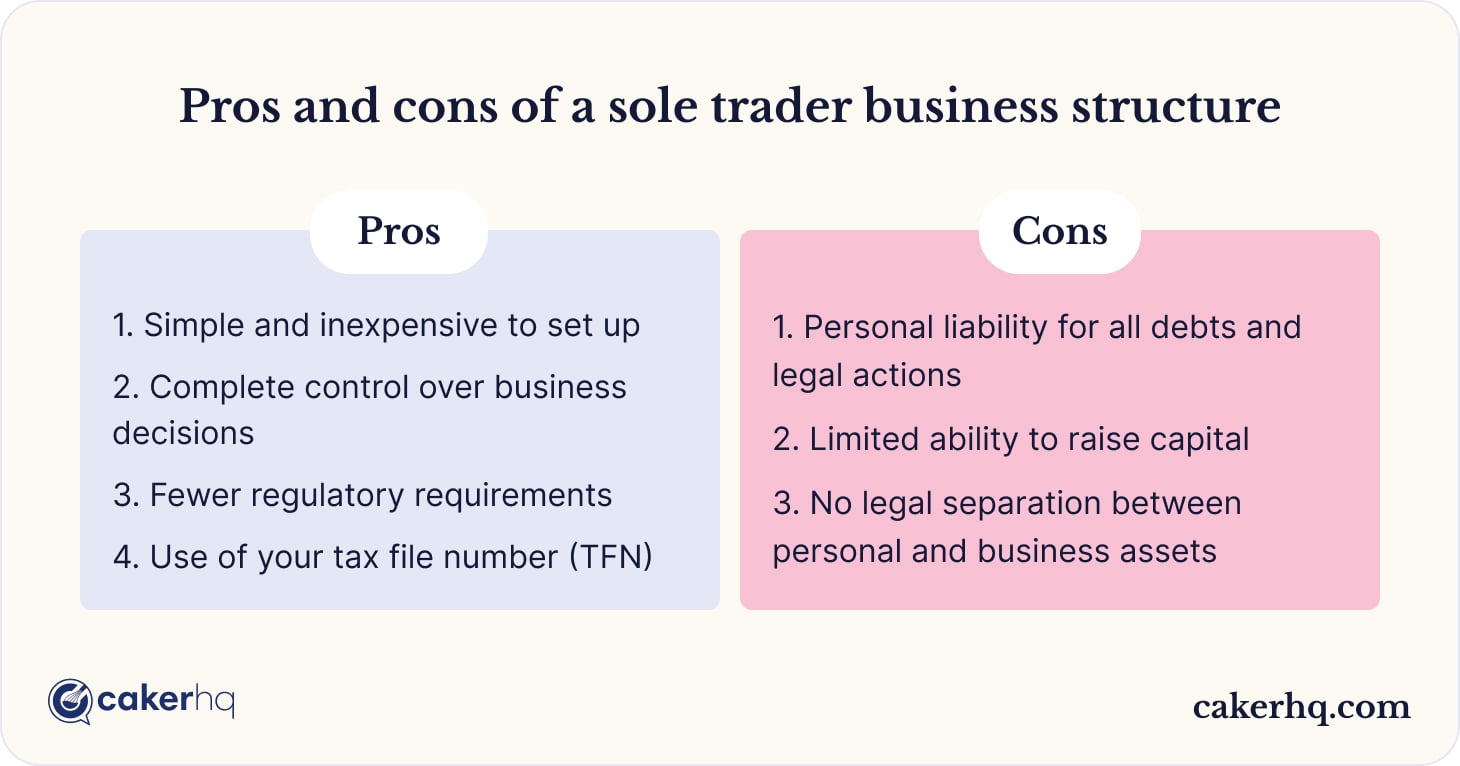

Essentially, there are three main types of business structures you can choose from. They are sole trader, partnership, and company. Each of them has its respective nuances, pros and cons.

Sole trader

A sole trader is the simplest and most common business structure in Australia. It is designed for individuals who want to run a business on their own. The sole trader is legally responsible for all aspects of the business, including debts, losses, and legal actions.

Pros

Simple and inexpensive to set up.

- Setting up as a sole trader is quick and cost-effective.

- You only need to register for an Australian Business Number (ABN) and your business name (if applicable).

Complete control over business decisions.

- You make all the decisions about how the business operates.

- No need to consult with partners or shareholders. This provides flexibility and independence.

Fewer regulatory requirements.

- Sole traders usually have fewer reporting and compliance obligations, unlike other business structures.

- Your tax reporting is combined with your personal income tax return, simplifying the process.

Use of your tax file number (TFN).

- You don’t need a separate tax file number for your business. Your personal TFN is used for tax purposes.

Cons

Personal liability for all debts and legal actions.

- You are personally responsible for any debts your business incurs. If the business cannot pay its debts, your personal assets, such as your home or car, may be at risk.

Limited ability to raise capital.

- As a sole trader, raising funds is more difficult. You rely on personal savings, loans, or revenue to grow your business.

No legal separation between personal and business assets.

- There is no distinction between your personal finances and business finances, which can complicate managing your accounts and taxes.

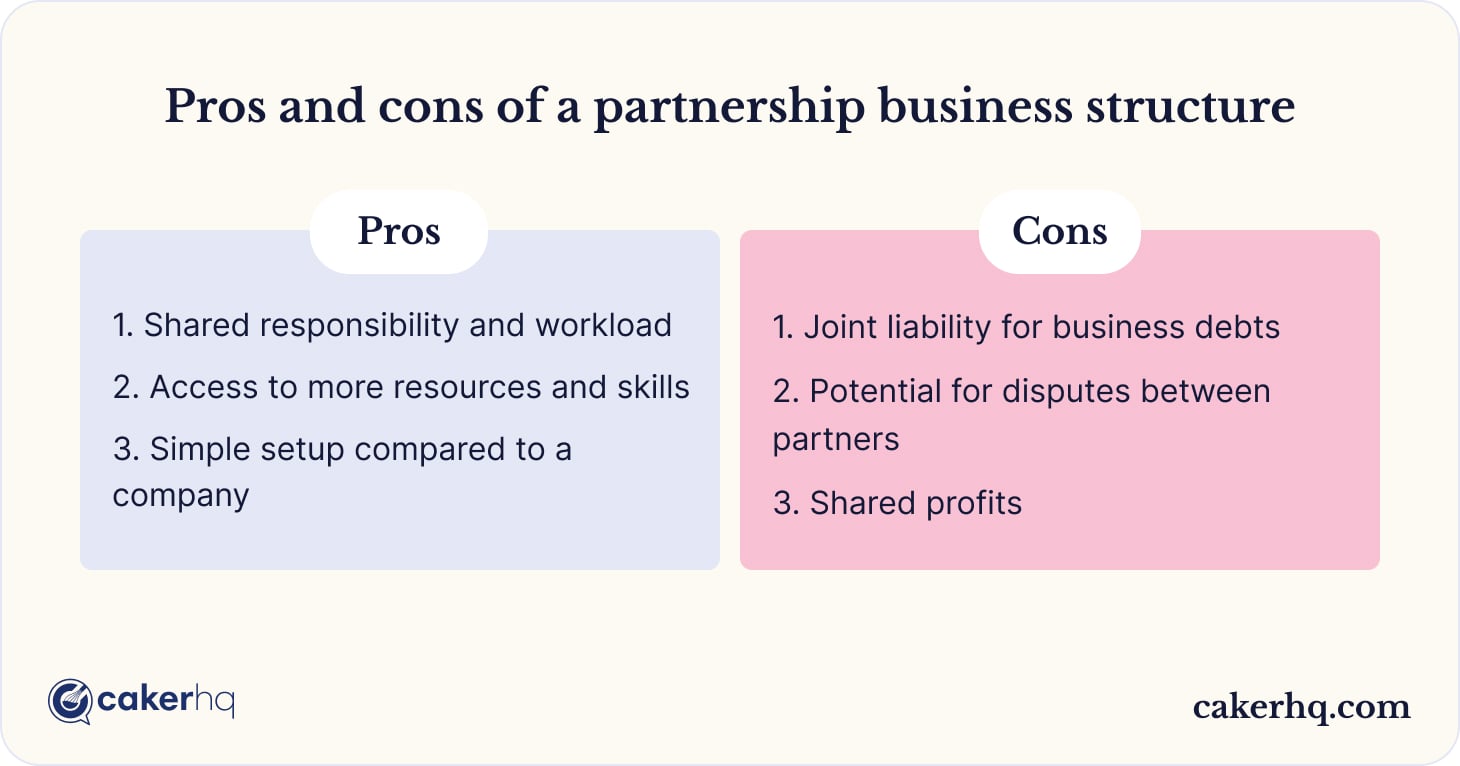

Partnership

A partnership is a business structure where two or more individuals or entities share ownership and responsibilities. Partners share profits, losses, and decision-making responsibilities according to an agreed-upon partnership agreement.

Pros

Shared responsibility and workload.

- Running a business is easier when tasks and responsibilities are divided among partners.

- Partners can bring complementary skills and expertise to the business.

Access to more resources and skills.

- A partnership allows the pooling of resources, such as finances and equipment, making it easier to start and sustain the business.

- Each partner may have unique knowledge or contacts that benefit the business.

Simple setup compared to a company.

- Partnerships require fewer formalities than companies.

- You’ll need to register for an ABN, a business name (if applicable), and draft a partnership agreement.

Cons

Joint liability for business debts.

- All partners are equally liable for the business’s debts, even if only one partner incurred the debt.

- Your personal assets may be at risk if the business cannot pay its liabilities.

Potential for disputes between partners.

- Differences in opinions, goals, or financial contributions can lead to disagreements.

- A well-drafted partnership agreement can help resolve disputes.

Shared profits.

- Business profits are divided among partners based on the partnership agreement. This may reduce individual earnings compared to being a sole trader.

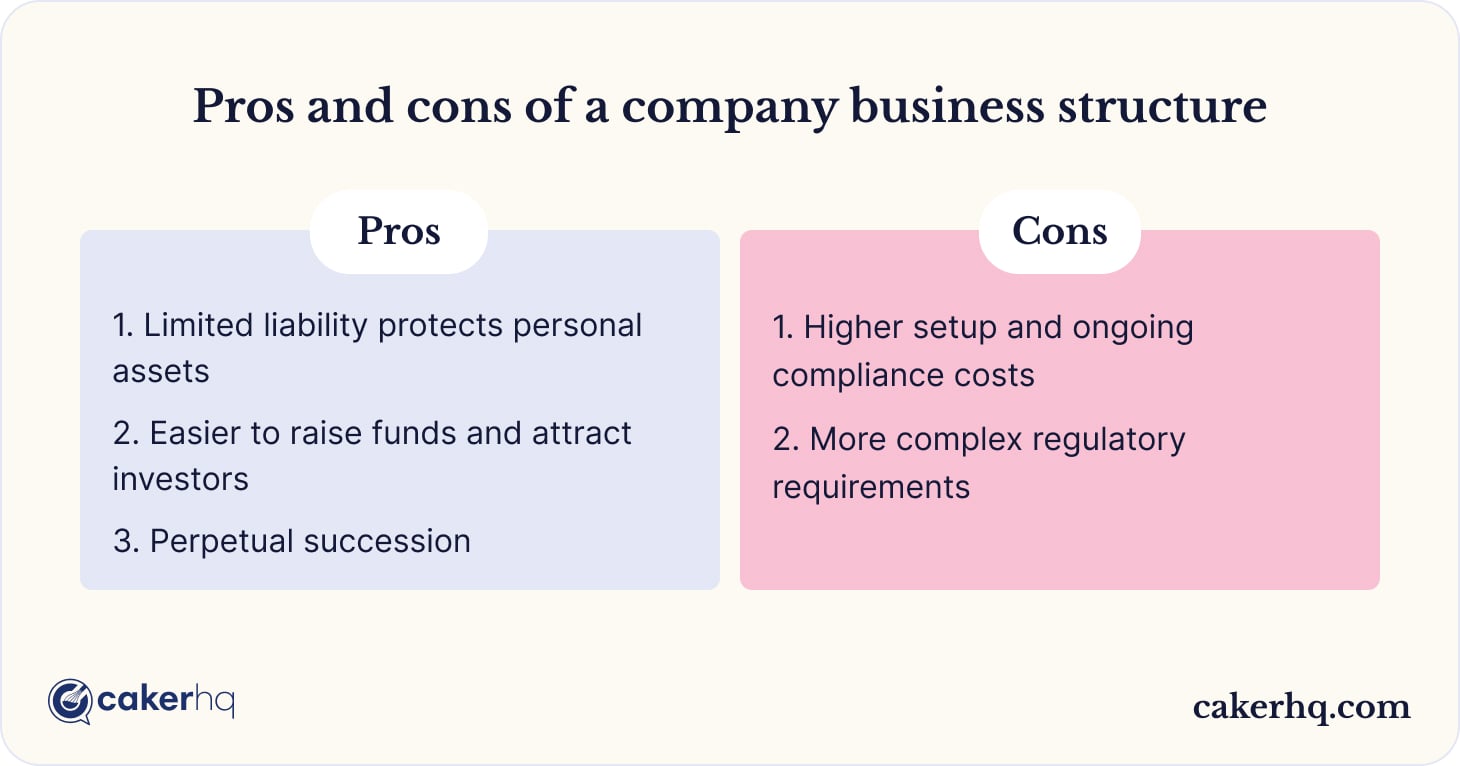

Company

A company is an advanced business structure. It is a separate legal model in which the business exists independently of its owners. A company is owned by shareholders and managed by directors. It is governed by the Corporations Act 2001 and must be registered with the Australian Securities and Investments Commission (ASIC).

Pros

Limited liability protects personal assets.

- Shareholders’ personal assets are generally protected from business debts and legal actions.

- Liability is limited to the value of their investment in the company.

Easier to raise funds and attract investors.

- Companies can raise capital by issuing shares to investors or securing loans more easily than sole traders or partnerships.

- This is the ideal model for businesses with high growth potential.

Perpetual succession.

- A company can continue to operate even if the ownership changes due to the sale of shares, resignation, or death of shareholders.

- This provides stability and continuity.

Cons

Higher setup and ongoing compliance costs.

- Setting up a company requires higher costs, including registration fees and legal documentation.

- Ongoing compliance, such as submitting annual reports and meeting corporate governance requirements, adds to the cost.

More complex regulatory requirements.

- Companies must adhere to stricter legal and reporting obligations, including maintaining financial records and holding director meetings.

- Directors can be held personally liable if they fail to meet their legal obligations, such as paying employee wages or taxes.

Each business structure has its benefits, and choosing the right one depends on your business goals. It's a good idea to seek advice from an accountant or business advisor to make the best choice for your situation

Ready to turn your passion for cake-making into a thriving business? Join CakerHQ and connect with customers all over Australia today! Join us today

Registering your business name

Registering your business name is a quick and straightforward process that ensures your brand is protected and ready to trade in Australia. Here are the ones you need to take if you’re creating a business in Australia specifically.

1. Search for availability.

Before registering your business name, you need to make sure it’s unique and not already in use. Visit the ASIC Business Name Register (accessible online) to search for your desired name. If your preferred name isn’t available, this is a great opportunity to get creative and find a name that truly reflects your brand.

Make it simple, memorable, and relevant to your cake business. Avoid names that could confuse customers or infringe on trademarks.

2. Register with ASIC (Australian Securities and Investments Commission).

Once you’ve found an available name, go to the ASIC website to start the registration process. You’ll need to create an ASIC Connect account if you don’t already have one.

After logging in, follow the step-by-step instructions to complete your business name registration. You’ll need to provide:

- Your desired business name.

- Your Australian Business Number (ABN), which is required for registration. (We will cover it next, no worries!).

- Your contact and business details.

3. Pay the registration fees.

There is a small fee to register your business name. As of 2025, the costs are $39 for one year, or $92 for three years. These fees may change over time, so check the ASIC website for the most up-to-date pricing. Payment can be made securely online during the registration process.

What happens after registration?

ASIC will process your application, and once approved, you’ll receive a business name registration certificate. Congrats! Your registered name is now protected, meaning no one else in Australia can use it.

Australian Business Number (ABN)

First, what’s ABN? It is a unique 11-digit number that identifies your business to the government and the public. It’s essential for tax and business transactions.

You will need it for several reasons.

First and foremost, you can’t register for Goods and Services Tax (GST) (if applicable) without it. You don’t have to register for GST when you apply for your ABN, however, you cannot register for GST without it.

It is also needed to issue valid tax invoices and receive payments, to claim business expenses and credits and to avoid having tax withheld on payments to your business.

The good news is that applying for an ABN is free and straightforward. Most applications are processed immediately, allowing you to get started quickly.

1. Check your eligibility. To apply for an ABN, you must be starting or running a business in Australia or be involved in a profit-driven activity.

2. Apply online. Go to the Australian Business Register (ABR) website to begin the application process. You’ll need to provide details like your business structure (e.g., sole trader, partnership, or company), your contact information, and the type of industry or business activities you’ll be conducting. Next, simply follow the step-by-step instructions on the website to complete your application.

3. Cost and processing time.

Thankfully, it costs nothing to apply for an ABN. Additionally, the majority of applications are accepted right away, so you'll have your ABN right away. On the other hand, some applications could take longer to process and need more verification.

Food business licensing

Starting a cake-making business in Australia requires strict adherence to food safety laws and regulations. To ensure your business complies with national and local standards, you’ll need to familiarise yourself with several concepts. Let’s cover each in greater detail.

Food standards in Australia

The Food Standards Code is a set of regulations developed by Food Standards Australia New Zealand (FSANZ) that outlines requirements for food safety, hygiene, and labeling.

The Food Standards Code outlines important rules for food safety, helping you maintain high standards in your cake business.

- Safe food handling. It oversees your processes to prevent contamination during preparation, storage, and transport.

- Allergen management. It forces owners to label and take measures to prevent cross-contamination accurately.

- Equipment and facilities. It provides standards for cleanliness, layout, and maintenance of your cooking area.

In other words, following Australian food regulations is not only advised but essential to the survival of your company. In addition, it helps shield your clients from foodborne illnesses, increases customer confidence and trust, and guarantees legal compliance to prevent fines or company closures.

Local council approvals

Before starting your cake business, you must seek approval from your local council. Note that requirements differ depending on whether you’re operating from home or a commercial kitchen.

Operating a food business from home

When it comes to building a cake-making business at home, there are several requirements.

- Your home kitchen must meet hygiene and safety standards as set by your local council. Many councils offer resources and support for home-based businesses, so don’t hesitate to reach out and ask for guidance

- Your kitchen may require additional modifications like installing a separate handwashing sink and improving ventilation or storage facilities.

- You will need to ensure that all surfaces are smooth, washable, and food-safe.

- Check your property’s zoning laws to ensure home-based businesses are permitted in your area. Note that some councils may impose restrictions on operating a food business from a residential property, such as limits on delivery times or customer visits.

To conclude, operating a home-based bakery has lower setup costs compared to renting a commercial space. Besides, it provides the convenience of working from home, which all people strive for nowadays.

The drawback is that space and equipment constraints may limit your production capacity. Additionally, to accommodate a kitchen improvement, your workspace might require alterations or renovations.

Operating from a commercial kitchen

If you decide to operate from a separate place, there are many other considerations you need to account for.

- If you’re renting a commercial kitchen, ensure the space meets council regulations.

- Some kitchens may require upgrades to comply with health and safety standards.

- A lot of councils allow small food enterprises to use common commercial kitchens. Your setup effort will be lessened because these areas have been pre-inspected and frequently satisfy compliance requirements.

- Shared kitchens can be rented hourly or daily, making them cost-effective for small-scale operations.

This scenario has its advantages and downsides. On the one hand, a commercial kitchen lets you have a larger production capacity with access to professional-grade equipment. Besides, these are often pre-approved facilities that reduce the risk of non-compliance.

On the other hand, renting a commercial space definitely has higher ongoing costs, including rent and utilities. Besides, you will need to coordinate schedules if sharing the space with other businesses.

Food Safety Supervisor (FSS)

In most Australian states, food businesses must have a certified Food Safety Supervisor (FSS) to oversee food handling practices. Simply put, it is is a formal qualification required by Australian food safety laws to ensure that every food business maintains high standards of food safety and hygiene.

So, why is this certification important?

First off, by making sure that food is handled, stored, and prepared properly, you can shield your patrons from foodborne illnesses.

Second, it ensures that your company conforms with local council legislation and the Food Standards Code. It also establishes a clear chain of accountability for food safety within the company.

But who needs to have the certification?

Every food business in Australia must have at least one designated Food Safety Supervisor.

However, this does not have to be the business owner unless you work as a sole trader. For instance, your manager, chef, or employee can be responsible for overseeing food handling and preparation.

A Food Safety Supervisor’s responsibilities include:

- Monitoring food safety practices. This person ensures proper handling, preparation, and storage of food to minimise contamination risks.

- Identifying hazards. They recognise potential food safety risks and implement measures to address them.

- Training and supporting staff. They guide team members on safe food practices and ensure they adhere to hygiene standards.

- Liaising with authorities. They act as the main contact during health inspections and audits by local councils or food safety authorities.

A Food Safety Supervisor (FSS) certification is a valuable qualification that helps you maintain high standards of food safety and hygiene in your business. Many short courses are available online, making it easy to get certified.

3. Kitchen compliance

Now, let’s move to the workspace itself. As with any other aspect of your business, it also should abide by some rules and requirements.

Health and safety inspections by local councils

Regardless of the type of kitchen, your local council will inspect it to see whether it meets health and safety regulations. Therefore, you need to focus on several factors.

First, it's the layout of your kitchen. To avoid cross-contamination, it should have proper layout, ventilation, and illumination.

Second, to prevent contamination or spoiling, ingredients, equipment, and completed goods must be properly stored.

Thirdly, the degree of cleanliness should also be taken into account. High standards of cleanliness must be upheld for utensils, equipment, and surfaces.

In order to deal with food scraps and packaging, you must lastly set up an appropriate waste management system.

Your local council is there to help ensure your kitchen meets safety standards. They often provide checklists and resources to guide you through the process.

Hygiene standards

Maintaining hygiene is critical for any food business. Regulations cover several aspects of cleanliness, storage, and food handling:

- Cleanliness. Surfaces and utensils must be cleaned and sanitised after each use. Floors, walls, and ceilings should be free from dirt, grease, and mold.

- Storage. Ingredients should be stored in airtight, labeled containers to prevent contamination. Refrigerated items must be kept at appropriate temperatures (below 5°C).

- Food handling. Employees must wash their hands frequently and wear clean clothing. Gloves should be used when handling ready-to-eat foods.

4. Insurance requirements

Running a cake-making business involves various risks, from customer injuries to damaged equipment. In this case, insurance is not merely an option but is often a necessity. Here’s why insurance is critical for your business and what types you can choose from. While this guide provides general information about insurance, it's important to consult with an insurance professional to ensure you have the right coverage for your specific business needs

Public liability insurance

This type of insurance protects your business if a third party (e.g., customer, supplier) is injured or their property is damaged due to your business activities. For instance, it can cover cases like accidents during delivery, customer injuries in your establishment, and many similar scenarios.

So, why it’s important?

It protects businesses that deal directly with the public. Besides, many event venues require proof of public liability insurance if you supply cakes for events.

Product liability insurance

With product liability insurance, you get protected if a customer becomes ill or suffers harm from consuming your product. This insurance covers issues like allergic reactions or contamination.

Why do you need it?

It’s impossible to predict what unique risks you will face in your day-to-day operations. For instance, you can accidentally mislabel allergens or fail to detect contamination during preparation, leading to a customer experiencing poisoning. In short, product liability insurance helps you handle legal claims or compensation without severe financial strain.

Equipment and property insurance

As the name implies, this type of insurance safeguards your equipment, tools, and property from damage, theft, or loss. This includes a variety of items, i.e., ovens, mixers, refrigerators, and storage units.

Why would you set for this insurance?

Of all people, you must know that baking equipment is expensive to replace. The bigger your business grows, the bigger your paychecks for new equipment. Thus, this coverage ensures your business can recover quickly from incidents like fires, floods, or break-ins.

5. Taxation and financial obligations

The list doesn’t end on the points listed above. Taxes, financial operations, and their accounting are other aspects you must handle. Fortunately or not, they are necessary for your business to remain compliant, avoid penalties, and operate efficiently. This section provides general information about taxation and financial obligations for cake businesses. We strongly recommend consulting with a qualified accountant or financial advisor to ensure compliance with Australian tax laws specific to your situation.

Goods and Services Tax (GST)

The GST (Goods and Services Tax) is a 10% tax levied on most goods and services sold in Australia, including cakes and baked goods. If you own a cake business, you should understand how GST works, when to register, and how to manage your duties.

When is GST registration required

You don’t need to register for GST automatically, but certain conditions make it mandatory.

- Your business has an annual turnover of $75,000 or more.

- Turnover refers to your total sales (before expenses) in a 12-month period.

- You provide services to clients or businesses already registered for GST.

Charging and reporting GST on sales

Once registered for GST, you need to manage it correctly to comply with Australian tax laws. Here’s what you’ll need to do:

- Add GST to your prices. When selling cakes or providing baking services, you must add 10% GST to your prices. For example, if you sell a cake for $100, the final price with GST will be $110.

- Providing GST-compliant invoices. All invoices must include your Australian Business Number (ABN), a breakdown of the GST amount (e.g., “$10 GST included in the total price”) and a statement indicating that GST is included in the total price.

Claiming GST credits

If you’ve purchased business-related items (i.e., ingredients, equipment, or packaging), you can claim the GST you paid on those items as a credit against the GST you’ve collected from your customers.

Lodging business activity statements (BAS)

A Business Activity Statement (BAS) is a report you submit to the Australian Taxation Office (ATO). It is needed to:

- Declare how much GST you’ve collected from customers.

- Claim GST credits for the GST you’ve paid on business expenses.

- Pay any GST owed after subtracting your credits.

The frequency of lodging a BAS depends on your business size and can be done monthly, quarterly, or annually. Most small businesses opt for quarterly lodgements.

Finally, here’s a practical example of GST calculation for BAS:

- GST collected from customers: $2,000.

- GST paid on business expenses: $500.

- GST to pay to the ATO: $2,000 - $500 = $1,500.

Record keeping

As you can see, there’s a lot to take in. It may be challenging to get used to, and thus, accurate record-keeping is essential. But, what records should you keep?

- Sales records. Document every sale you make, whether it’s an in-person transaction, online payment, or an invoice to a customer. Keeping these records ensures you have a clear picture of your income.

- Expense records. Maintain records of all business-related expenditures, including those for advertising, cooking space rental, and ingredient purchases. These documents are essential for tracking your spending and claiming deductions.

- Bank statements. Open a dedicated business bank account to simplify your finances. This separation makes it easier to track income and expenses and prevents personal and business transactions from getting mixed up.

The procedure is made simpler, time is saved, and mistakes are decreased by using bookkeeping software. Tasks like tax preparation, cost management, and invoicing are automated by programs like Xero, MYOB, or QuickBooks. Additionally, these technologies produce reports that assist you in tracking business performance and cash flow.

Income tax and deductions

If you’re running a cake business, understanding how income tax and deductions work is essential. It ensures you stay compliant with Australian tax laws while maximising your potential savings.

Reporting your income

When tax time comes, you must report all the money your business has earned. Use your Australian Business Number (ABN) and detailed business records to calculate your taxable income. This includes all sales and earnings from your cake-making activities.

If you’re a sole trader, your business income is combined with your personal income on your tax return. This means your profits will be taxed at your personal income tax rate.

Claiming business-related deductions

The ability to deduct qualified expenses from your taxable income is one benefit of owning a business. You pay less in taxes as a result of these deductions. The following are typical deductible costs for cake businesses:

- Ingredients and baking supplies.

- Equipment and maintenance costs, such as ovens, mixers, or tools.

- Rent for a commercial kitchen or a portion of home utilities if working from home.

- Marketing and advertising expenses, including website hosting or social media ads.

- Training or certification fees, such as Food Safety Supervisor courses.

Small business tax concessions

As a small business owner, you may qualify for additional tax benefits, such as:

- Instant asset write-offs. Deduct the full cost of eligible equipment purchases, like a new oven or cake display stand, immediately rather than over several years.

- Simplified depreciation rules. Spread out the cost of large assets over time with less paperwork.

- Pre-paid expenses. Deduct costs like insurance or subscriptions that are paid in advance for the following financial year.

Looking to start your cake-making business? Join us! Become a professional

6. Labelling and marketing laws

Your marketing and proper labeling also have some legal requirements. Besides, there’s an ethical aspect to it: clear and accurate labels protect consumers and help them make informed decisions, while truthful marketing safeguards your business reputation.

Food labelling standards

All food products, including your cake menu, must have clear and accurate labels. It helps shield clients from any health hazards and guarantees they can make educated decisions. You should include a variety of information on your label:

- Ingredients list.

Include all ingredients in descending order by weight, using common names (e.g., “flour” instead of “wheat flour”) for clarity. This makes it easy for customers to understand what’s in your products.

- Allergen declaration.

You must disclose common allergens, such as nuts, eggs, milk, soy, gluten, and seafood. These allergens should be clearly highlighted (e.g., in bold or in a separate section) to ensure visibility and safety for customers with dietary restrictions.

- Nutritional information.

If required, provide a Nutrition Information Panel (NIP) detailing energy, protein, fat, carbohydrates, sugar, and sodium per serving and per 100g. Small businesses selling directly to customers without pre-packaging may not need an NIP, but it’s important to check with local regulations.

- Country of origin labelling.

Your labels must state where the product was made, grown, or packaged. For example, include statements like “Made in Australia from at least 50% Australian ingredients.” This transparency builds trust with your customers and complies with the Australian Competition and Consumer Commission (ACCC) standards.

Truth in advertising

When marketing your cake business, honesty is crucial. Misleading claims can lead to legal consequences and harm your reputation.

- Health and nutritional claims.

Only make claims you can verify. For example, if you advertise your cakes as “gluten-free,” ensure they meet the necessary certifications. Avoid vague statements like “100% organic” unless fully validated.

- Product representation.

Ensure that images and descriptions of your cakes accurately reflect their actual size, appearance, and ingredients. Avoid exaggerating designs or editing photos in a way that misleads customers about what they will receive.

- Australian Consumer Law (ACL) compliance.

The ACL, enforced by the ACCC, protects consumers from deceptive or misleading practices. Your cake business must adhere to ACL’s key requirements:

- Deliver cakes that match the descriptions provided.

- Honour guarantees, such as quality, freshness, and timely delivery.

- Clearly communicate your terms of service, including refund or replacement policies.

- Be cautious with marketing to children and families. Avoid using deceptive promotions or unhealthy product claims that violate advertising standards.

When it comes to selling and labeling your cakes, transparency is essential. Always be truthful and transparent about your items' contents, allergens, and costs. To guarantee that clients' expectations are fulfilled for custom orders, be sure to keep them informed about the design, size, and delivery schedule.

To ensure that your social media marketing campaign accurately depicts the finished product, utilise real photos of your cakes and refrain from severely manipulating them. Lastly, keep abreast of modifications to food labeling and marketing laws to make sure your business is reliable and compliant.

When in doubt, it's always best to be transparent and clear in your marketing and labelling. Not only does this build trust with your customers, but it also helps you stay compliant with Australian Consumer Law.

Bottom line

Navigating the legal and licensing requirements for your cake business is an important part of setting up for success. While there are a few steps involved, with the right guidance, it can be a straightforward process that ensures your business is set up correctly from the start. We sincerely hope this article answers questions you wonder about.

If you found this guide helpful, explore our blog for more practical tips and advice on building a successful cake business. When you’re ready to take the next step, join CakerHQ and connect with customers all over Australia! You’re always welcome to become a professional featured on CakerHQ. Not only do we provide a platform, but we also help you deal with tons of tedious admin tasks.

Disclaimer: The information provided in this article is for general informational purposes only and is not intended as legal, financial, or professional advice. We recommend seeking independent advice from qualified professionals regarding your specific business circumstances to ensure compliance with all relevant laws and regulations