Turning a hobby into a business, and especially a profitable one, is a super exciting process. It’s many people’s dream to get a stable income from doing what they simply love. If you’re as good at cake-making as in dreaming, then this article is for you.

In this piece, we’ll look into how you can turn your cake-making passion from a hobby to a profitable business. We’ll overview key goals to start a baking business in Australia, as well as crucial tips for you to structure and develop your business.

Assessing your passion and skills

Turning your baking hobby into a successful business starts with a thorough assessment of your passion, skills, and the market. Before diving into the business side, and especially investing money and time, it’s essential to understand where your strengths lie, where you can improve, and how your style of baking fits into market demand.

Understanding the market

Figuring out an actual demand for your goods is a crucial first step you mustn’t neglect. The baking world is vast, with many different styles and specialties, from cakes and pastries to bread and confectionery. Before you start a baking business in Australia, it's important to evaluate whether there’s an audience that wants what you create. To figure it out, you can:

- Research local demand. Begin by exploring the local market. Look at nearby bakeries, farmers' markets, and food events to get a sense of what types of baked goods are popular. Are there certain products missing? For example, if there’s no bakery offering gluten-free or vegan treats, this could be a gap you could fill.

- Analyse online trends. Platforms like Instagram, Pinterest, and TikTok can give you insights into trending baked goods and popular flavours. You can also research popular hashtags or look at the most liked posts in the baking community, allowing you to understand what consumers are excited about.

- Understand seasonality. Some baked goods have more demand during specific times of the year, like cookies and festive cakes around holidays. Assess whether your products are in demand year-round or if you’ll need to plan for seasonal peaks.

- Figure out your ideal audience. Is it health-conscious individuals looking for sugar-free options, brides seeking custom wedding cakes, or busy families looking for convenient yet delicious treats? Knowing what category of people to target will help you tailor offerings to meet their preferences.

Skill development

Being a professional cake-maker doesn’t mean you can run a great business right off the start. Running a business requires mastery beyond your current skillset. Regular learning and practice are essential to becoming a professional and staying relevant in a competitive market. Here are several tips.

Do not neglect learning. To refine your baking skills, consider enrolling in specialised baking courses. These could range from general baking techniques to more niche areas like cake decoration, French patisserie, or gluten-free baking. Such events let you stay current with market demands.

Keep evolving by experimenting with new methods and recipes. Challenge yourself to work on new goods that go beyond your comfort zone. With more practice, you will gradually become more proficient with a diverse range of products.

Develop business skills. As a business owner, you will need to learn essentials like marketing, pricing, and customer service. Consider taking business or entrepreneurial courses geared toward small food businesses to understand the full spectrum of running a profitable operation.

Seek feedback regularly. Let friends, family, or even early customers taste your products and give constructive criticism. With more feedback, you can fine-tune your recipes and presentation for future success.

Niche selection

Finding a narrow niche is essential to stand out against the competition. With a thoughtful niche choice, you can focus your efforts and attract loyal customers who appreciate your unique offerings.

For instance, begin by asking what kind of baking you love most. Whether it’s creating detailed fondant decorations for cakes, making rustic, artisanal breads, or crafting delicate pastries, your niche should align with your passion and strengths. This way, you’ll retain your hobby passion while providing something special that resonates with your audience.

Next, if you notice that there aren’t many vegan or allergy-friendly bakeries in your area, this could be your opportunity. Similarly, if you’re skilled at creating elaborate wedding cakes or themed treats for special occasions, you could carve out a space as a go-to bakery for custom orders.

When you’re just starting a baking business in Austalia, offering a wide variety of baked goods may be tempting. However, try specialising in a specific niche not to get lost in the variety. For instance, focusing on high-end wedding cakes can make your brand synonymous with luxury and special events, whereas specialising in sourdough or artisan bread can attract a dedicated customer base who appreciates the quality of craftsmanship.

Setting up your baking business

Setting up a baking business involves making important legal and structural decisions to ensure your business runs smoothly and complies with regulations. Let’s look at the three aspects that are crucial to understanding.

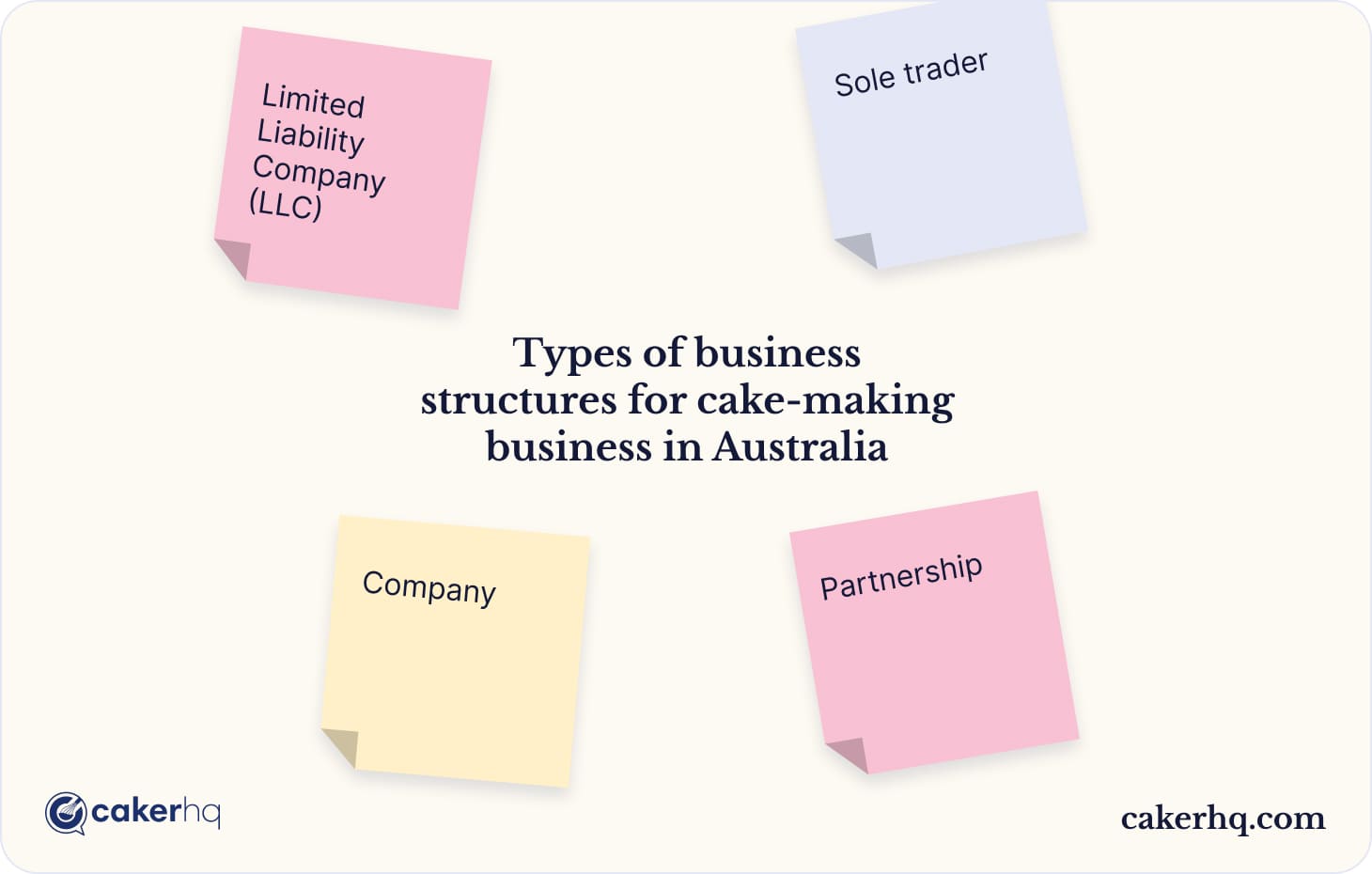

Business structure

Choosing the right business structure is a foundational decision you’ll make as a new business owner. The structure you choose will affect a ton of things, from how you pay taxes to the amount of paperwork you’ll need to handle. If you’re based in Australia, you will most likely be choosing from the following options:

- Sole trader. Similar to a sole proprietorship in other countries, a sole trader is the simplest business structure. You operate the business under your own name or a registered business name. You report profits and losses on your personal tax return, but you are personally liable for all debts, meaning your personal assets are at risk.

- Partnership. In a partnership, two or more individuals share the business's profits, losses, and liabilities. There are various types of partnerships, including general and limited partnerships, each with different liability implications. A partnership must register for an Australian Business Number (ABN) and file a partnership tax return.

- Company. A company is a separate legal entity from its owners, meaning it can own property, sue, and be sued independently. It provides limited liability, which protects owners’ personal assets from business debts. However, companies have more complex tax rules and regulations to follow.

- Limited Liability Company (LLC). In Australia, the closest equivalent to an LLC is the Proprietary Limited (Pty Ltd) company structure. It separates personal and business liabilities and allows for a flexible tax regime, but it also involves more regulatory responsibilities.

We recommend you speak with your accountant who will be able to guide you in the right direction to suit your own individual circumstances.

Legal requirements

Once the business structure choice is made, the next step is to ensure you’re meeting all legal requirements. Running a food-related business comes with specific permits and regulations, especially concerning health and safety.

Permits and licenses

If you’re operating in Australia, you may need to register your home-based business with your local council. While there isn't a specific "cottage food license," home-based food businesses must meet food safety standards set by local authorities. Local councils often have zoning laws that govern whether a home-based business can operate. You must ensure your home is appropriately zoned.

Additionally, you are required to register your food business with your local council under the Food Act 2003 (NSW) or similar state-specific regulations. You may also need to follow the Australia New Zealand Food Standards Code.

Most states in Australia require you to complete a food safety course, and some require a designated Food Safety Supervisor, especially in New South Wales and Queensland.

Additionally, you will need to register for GST in case your turnover is more than AUD $75,000 annually. Again, your accountant can assist you with this process.

Health and safety regulations

If you run a food business from home, your kitchen may be inspected by the local council to ensure it meets hygiene and safety standards. These regulations are even more relevant if you work with perishable goods, just like baked products.

When it comes to proper ingredient storage, you must comply with the Food Standards Code, which mandates the labeling of ingredients and allergens, such as nuts, gluten, and dairy. However, renting a commercial kitchen may be a better option if your home kitchen does not meet the council's standards or you want to scale up production.

Registering you business

To set up a business in Australia, you’ll need to register your business name with the Australian Securities and Investments Commission (ASIC) if you're operating under a name other than your own. You will need an ABN (Australian Business Number) and should consider registering for GST if your turnover exceeds the threshold.

Insurance

Even the best-run businesses face risks, and having the right insurance policies in place can protect you from unforeseen incidents that could harm your business financially.

General liability insurance is one of the most important types of insurance for a cake-making business. It protects you from claims of bodily injury, property damage, or personal injury resulting from your products or operations. For example, if someone gets sick after eating your baked goods or if you accidentally damage property while delivering a cake, this insurance would cover legal fees and potential settlements.

Next, product liability insurance is particularly important for businesses that produce food products. Product liability insurance can cover medical costs and legal fees if one of your customers gets sick or has an allergic reaction due to your baked goods. Even if you take all the necessary precautions, accidents can happen, and product liability insurance helps protect you from costly lawsuits.

Another one you should consider is business property insurance. If you use specialised equipment for your baking business, such as commercial-grade ovens, mixers, or refrigerators, business property insurance will cover repair or replacement costs if that equipment is damaged or stolen. This can also apply to your home kitchen if you work from home.

In this case, your homeowner’s insurance may not cover losses that are business-related. You might need to add a home-based business endorsement to your homeowner’s insurance or get a separate policy to cover your business assets.

Building your brand

Building a strong brand is important once you decide to transform your baking hobby into a thriving business. However, brand development is not only about name and logo. It reflects your personality and identity revolving around it.

Creating a brand identity

There are three core parts that come into creating a brand identity.

- Naming. Choose a memorable name that reflects your cake-making style, reflects your skills, and is easy to spell and pronounce. Make sure it aligns with your specialisation and is unique as is.

- Logo. Your logo is key to your brand identity and should be simple, recognisable, and suited to your style. Use colours and fonts that match your brand’s tone—bright and playful for a fun mood or muted and elegant for high-end ones.

- Brand message. Communicate your business’ values, story, and what makes you unique, such as using organic ingredients or catering to specific diets. Make sure your brand’s voice is steady across all platforms.

Defining your unique selling proposition (USP)

Your USP is what highlights you among many other businesses on the market. As with brand identity, USP is built upon several pillars.

Firstly, identify what makes you unique. Start by analysing your strengths as a professional. What do you offer that other bakeries don’t? It could be your use of premium, locally sourced ingredients, your ability to create intricate custom cakes, or a unique flavour profile that sets you apart. Your USP could also focus on your exceptional customer service or the convenience of offering delivery for your baked goods.

Secondly, focus on your audience. Your USP should be aligned with what your target customers value most. For example, if your buyers are primarily health-conscious individuals, you can channel your efforts on the use of organic, all-natural ingredients. If you cater to brides and event planners, your USP could highlight your ability to create stunning, custom cakes for special occasions.

Lastly, communicate your USP. Once you’ve defined your USP, make sure it’s clear in all your branding and marketing materials. Your packaging, social media accounts, and website should all show why your business is unique. Communicating your unique selling proposition will assist you in building a strong brand.

Packaging and presentation

Packaging and presentation play a pivotal role in defining your brand and creating a lasting impression on customers. Attractive, well-thought-out packaging protects your products and improves your customers’ general experience.

For instance, as previously mentioned, Your packaging should align with your brand’s colours, logo, and messaging". For eco-friendly brands, use sustainable materials and communicate this on the packaging. This will dramatically elevate your presentation.

Source: Unsplash

Apart from the aesthetic aspect, ensure the packaging is, first and foremost, practical. It should perfectly protect baked goods during transport and storage, especially delicate items like cakes and cupcakes.

Pricing your products

When it comes to pricing your goods, it’s essential to find the balance between all aspects. Simply put, you need to find out how to cover the expenses of making your goods, make a profit, and remain competitive in the market.

Cost analysis

Before you can set prices for your baked goods, you need a clear understanding of all the costs involved. This goes beyond just the ingredients—you’ll also need to account for labour, packaging, and overhead. Here’s a short breakdown of all the important aspects to consider.

Ingredient costs

Start by calculating the cost of every ingredient that goes into your baked goods. This includes everything from flour, sugar, and eggs to more specialised ingredients like chocolate, nuts, or flavourings. You can either do it manually or use a specialised cake cost calculator developed by our team.

Next, for each recipe, figure out the cost per unit (e.g., the cost per cup of flour or per ounce of chocolate). Multiply these by the quantities used in your recipe to get the total ingredient cost for each product.

Additionally, consider buying ingredients in bulk if your business is growing. Bulk purchasing can help lower the cost per unit, increasing your profit margins.

Labour costs

Even if you’re currently the sole professional in your business, it’s important to factor in your time as part of the cost. In other words, always remember that your labour has value, and ignoring it can result in underpricing.

To address it, assign yourself an hourly wage and calculate how long it takes to bake a batch of goods. Divide that time by the total number of products you make to get the labour cost per item. Besides, if you decide to hire help in the future, you’ll need to factor in the wages for your employees as part of your labour cost.

Overhead costs

Whether you’re baking at home or in a commercial space, you’ll need to account for the costs of utilities like electricity, gas, and water. Estimate how much of your monthly utility bill is used for your baking business.

If you’re renting a kitchen or paying for additional space to store baking supplies, factor this into your costs. Even if you work from home, you might want to allocate a part of your rent or mortgage as a business expense.

Note that equipment maintenance and replacement should also be accounted for. Over time, mixers, ovens, and other tools will wear out, so be sure to spread out the cost of replacing them over many months.

Packaging materials—such as boxes, cake boards, wrapping, and labels—should also be included in your overhead costs.

Setting profitable prices

Once you’ve got your total costs all figured out, you will need to set prices. They, however, should not only be profitable, but also cover all previously mentioned expenses. Yet, balancing this is paramount, as pricing too high might drive customers away, while pricing too low can erode your profits. Here are some strategies:

Cost-plus pricing

This strategy involves adding a markup to your total cost to ensure a profit. The formula itself is quite simple too:

- Total cost per item + desired profit margin = price

For example, if it costs you $10 to make a dozen cupcakes and you want to make a 50% profit margin, you would sell the cupcakes for $15 ($10 + 50% markup).

Note that the markup percentage will depend on your niche and market. Luxury, artisanal goods may allow for a higher markup, while mass-market products might need a smaller one to remain competitive.

Competitive pricing

Research your competitors’ pricing to understand what similar products are being sold for in your area or online. Competitive pricing ensures that you’re not overpricing or underpricing your products.

For instance, if your prices are higher than your competitors, make sure your customers understand the added value, such as premium ingredients, customisation, or exceptional service. If you’re offering gourmet baked goods or specialty products (e.g., vegan, gluten-free), you can justify charging a premium.

Value-based pricing

With value-based pricing, you set prices based on the perceived value of your baked goods to the customer. This method works well when you offer unique or premium products that customers are willing to pay more for.

For example, custom wedding cakes are often priced much higher than the cost of ingredients and labour because they are viewed as luxury, once-in-a-lifetime items. Consequently, people are more likely to pay a premium for goods in nice packaging that is personalised and top-quality.

Special offers and discounts

When it comes to implementing discount systems and promotions, you should avoid them cutting into your profits. There are various strategies you can adopt, even comprising several within your business model.

Offering promotional

Promotions is a broad term, often meaning one of several offers you can offer buyers. One of them is running a promotion for a limited time. It can create urgency and encourage customers to buy. For example, offering 10% off on all orders during a holiday weekend or providing a discount on new product launches can generate excitement and increase sales.

Another way to offer a discount without reducing your profit margins is to bundle products together. For instance, you could offer a discount on a cupcake and coffee set rather than offering a discount on each item individually. This increases the perceived value while encouraging customers to spend more.

Referral discounts

Quite simply, referral discounts reward your customers for attracting newcomers, be they friends, family members, or colleagues. For example, offer a discount to a customer when they refer a friend who places an order. This helps you grow your customer base without having to rely on traditional advertising, and the cost of the discount is offset by the new business.

Loyalty programs

In your loyalty program, you can offer various discounts or free items all to generate repeat purchases. For instance, after a person makes several purchases in a row, you can offer a free product on the 5th or 10th purchase. This motivates loyal buyers to stick with your business and continue buying from you.

Ready to take the next step? Join CakerHQ today and turn your baking passion into profit with our supportive community and resources. Become a professional

Marketing and selling your baked goods

Marketing your goods is a sound strategy to transform your hobby into profitable venture. While the quality of your work is essential, effectively promoting and selling them is what will drive your success. Frankly, there are a lot of things to take into account when it comes to marketing. Here are a few of them.

Online presence

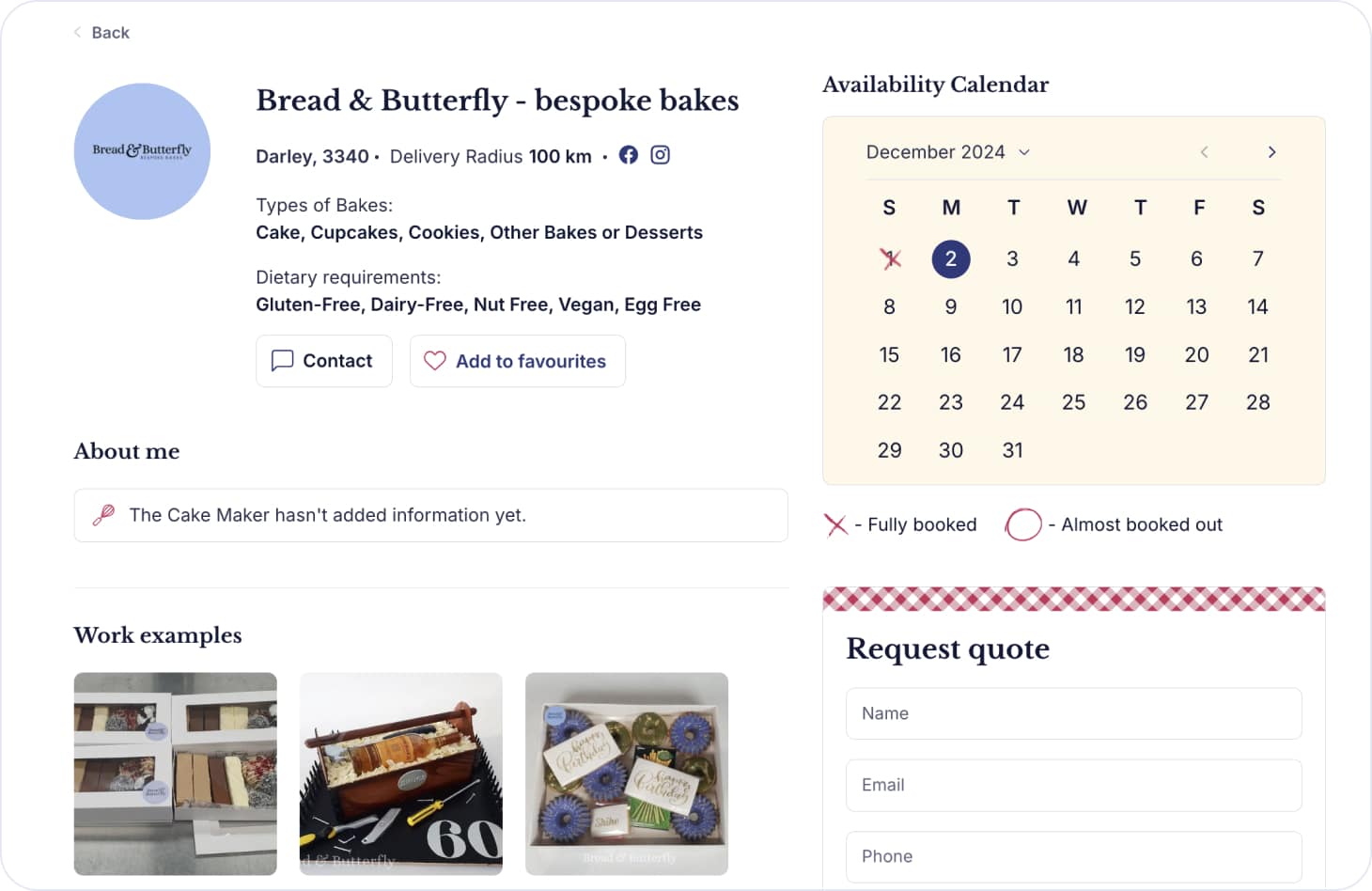

Nowadays, it’s too challenging to run a business entirely offline. Quite the contrary, your website and social media profiles serve as your online storefront, helping you showcase your products, take orders, and interact with customers. For this reason, you definitely need a website and/or specialised social media profiles.

Basically, your website, social media, and CakerHQ profile serve as a central hub for your business. They all should feature high-quality images, detailed descriptions, and accurate price tags. Include a gallery of your work, whether it's cakes, cupcakes, or specialty items, to attract potential customers.

The ability to place orders directly on your website makes it super comfortable for users to buy goods from you. Make sure the ordering process is simple and user-friendly, with clear instructions on how to select items, choose delivery or pickup, and make payments. Alternatively, consider that on CakerHQ, this functionality is available to all cake-makers.

Besides, remember to optimise each platform regularly. For instance, your website will greatly benefit from SEO optimisation, social media – from regular and thoughtful posting, and the CakerHQ profile from regular updates.

Social media marketing

Social media platforms like Instagram and Facebook offer powerful tools to market your baked goods, reach new customers, and grow your business. Here’s why these two are the most important among all other social media.

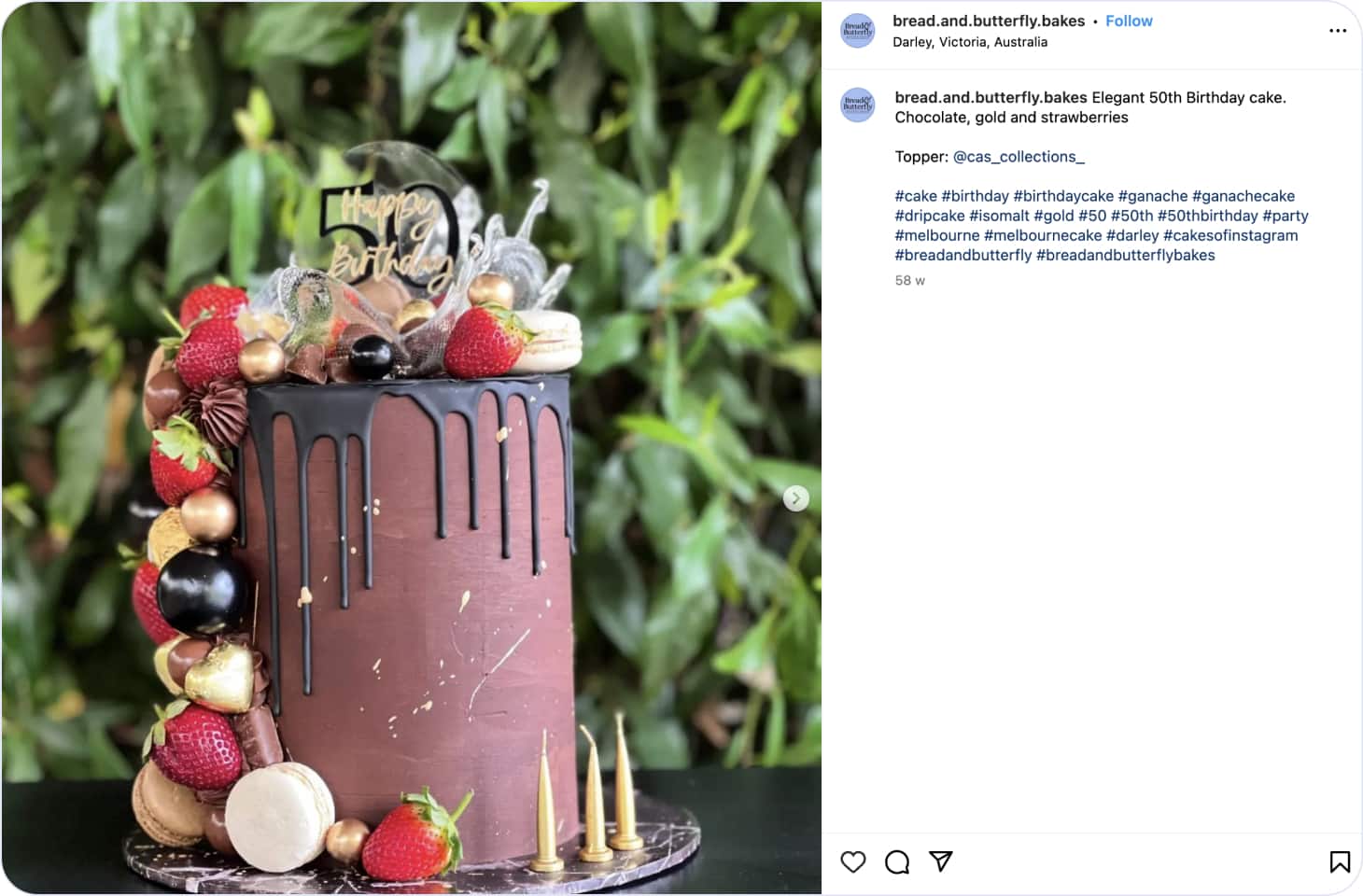

- Visual content. Since Instagram is a highly visual platform, it’s ideal for presenting your cakes and other goods. Post high-quality, beautifully styled photos of your creations. Use natural lighting and minimal backgrounds to highlight your products.

- Instagram Stories and Reels. Stories and reels allow you to share short, engaging content that the majority of users prefer over traditional posts. This can include the baking process, various tips, or “behind-the-scenes” moments. Stories also allow you to post limited-time promotions and interact with people through polls, Q&A, and countdowns.

- Hashtags. Instagram supports hashtags that allow users to search for super-specific content. You can make use of them to reach a broader audience. Research local hashtags to target customers in your area, and find several popular ones in your niche.

Source: Bread & Butterfly on Instagram

- Community engagement. Facebook is a great platform for creating a community around your business. You can post regular updates, share customer reviews, and even create a Facebook group for loyal customers to share their experiences.

- Facebook Ads. Invest in Facebook Ads to target your local community or specific demographics, such as people interested in baking or those looking for custom cakes for special occasions. Facebook’s targeting options allow you to reach potential customers based on their location, interests, and behaviors.

Word-of-mouth and local promotion

While online marketing is crucial, word-of-mouth and local promotion are equally important for a home-based baking business. This type of promotion can be achieved in different methods.

Farmers' markets

In every part of the world, there are markets you can visit. Setting up a booth at farmers' markets is an excellent way to showcase your products and interact directly with customers. Bring samples of your baked goods, and use the opportunity to network with local food enthusiasts.

Being present at local events or farmers' markets helps build relationships with customers who appreciate locally-made artisan products. It also gives you the chance to get immediate feedback on your products.

Partnering with local cafes and stores

Presenting your goods in local establishments can greatly expand your reach. Offer to supply these businesses with your baked goods or set up a pop-up shop in their locations. This way, you are able to introduce yourself to a wider customer base while enhancing your local reputation.

Collaborate with local establishments to cross-promote your products. For example, if you’re partnering with a café, they could feature your products in their shop, while you promote their coffee on your social media platforms.

Word-of-mouth referrals

Encourage happy customers to refer your business to their friends and family. Special purchases and discounts on their next orders can help foster customer referrals.

Besides, you can always ask to leave reviews and comments about your business on Facebook, Google Business, or Yelp. Positive reviews are powerful endorsements and can help attract new buyers who are seeking for a reliable cake-maker in your area.

Looking for a way to grow your audience? Became a professional with CakerHQ. Sign up now

Financial management

Proper financial management is another foundational brick when you’re planning to build a baking business aiming for long-term success. From tracking income and expenses to understanding taxes and planning for growth, managing your finances ensures that you can sustain and scale your business over time.

Tracking income and expenses

Managing your business finances is mostly about properly tracking both your revenue and spending accurately. So why good bookkeeping practices are essential?

- Cash flow management. Keeping a detailed record of all sales and expenses helps you understand how much money is coming in and going out. By staying on top of your cash flow, you can be certain that you can address all expenses like ingredients, utilities, and payroll.

- Profitability analysis. Accurate bookkeeping allows you to assess whether your business is profitable. You’ll be able to identify your most profitable positions and on which ones you might be overspending.

- Financial forecasting. Having organised records enables you to predict future financial needs, such as purchasing more equipment, hiring staff, or saving for a slow season. Financial forecasts help you set realistic goals and be ready for future business challenges.

Moreover, there are tons of specialised tools to help you do so. To name a few, financial platforms like Xero or QuickBooks can help you with tons of generic accounting tasks. These automate expense tracking, help in generating financial reports and deal with taxes.

If your business is still small, a detailed spreadsheet can also work for tracking expenses and income. However, as your business grows, investing in proper accounting software is recommended to streamline your bookkeeping.

Taxes and deductions

Understanding the basic tax requirements for your baking business is critical to avoiding penalties and making the most of available deductions. Speaking of taxes, particularly in Australia, there are several taxes for you to consider:

- Income tax. As a sole trader in Australia, your business income is considered personal income and is taxed at individual income tax rates. The tax-free threshold is $18,200, meaning you won’t pay tax on the first $18,200 of your income. Earnings above this threshold are taxed progressively.

- Medicare Levy. In addition to income tax, individuals are subject to the Medicare Levy, which is typically 2% of your taxable income. This levy contributes to the funding of Australia’s public healthcare system.

- Registration threshold. If your annual turnover is $75,000 or more, you’re required to register for GST. Once registered, you must collect a 10% GST on your sales and remit it to the Australian Taxation Office (ATO).

- GST-free items. Some food items are GST-free. For example, bread without a sweet filling or topping is GST-free, while cakes and pastries are taxable. It’s important to determine the GST status of your products to ensure compliance and whether you are required to register for GST.

- Pay As You Go (PAYG) installments. Unlike salaried employees, sole traders don’t have tax automatically withheld. To manage your tax obligations, you may need to make PAYG installments, which are regular prepayments towards your expected tax liability. This system helps spread your tax payments throughout the year.

Investment and growth

As your business becomes profitable, reinvesting your earnings with a thoughtful plan is the right way to achieve sustainable growth. Whether it’s upgrading equipment or expanding your workspace, thoughtful investments can help you increase production and revenue.

1. Reinvesting profits in your business.

Improving your equipment overtime can greatly benefit your business’ efficiency and output. For example, a larger commercial oven may allow you to bake more goods at once, reducing labour time and increasing capacity.

If you find yourself running out of space as demand grows, consider upgrading your kitchen or moving to a commercial space. Expanding your workspace can help streamline production and allow for future growth.

Reinvesting in marketing, such as social media ads, SEO for your website, or professional photography for your products, can help you attract new customers and build a strong brand presence.

2. Planning for long-term growth.

It’s wise to set aside a portion of your profits for future needs, such as unexpected equipment repairs, slow seasons, or emergencies. A reserve fund will help you stay afloat during challenging times.

Before making major investments, such as opening a new location or expanding into wholesale, carefully evaluate the risks and potential rewards. Analyse market demand, your financial position, and your capacity to handle the additional work before making a commitment.

Conclusion

Obviously, a lot of work goes into transforming your hobby into a profitable business. Although this path has a lot of obstacles that may overwhelm you at first, it is 100% doable. Moreover, this article outlines most aspects you should consider . Turning a hobby into a thriving business is an exciting journey, and one many dream of.

If you are determined to do it, it only takes a little effort to start a baking business in Australia. Alternatively, the overwhelming effect is hard to neglect, and if that’s the case for you, feel free to become a professional on CakerHQ.

Naturally, we provide not only all the benefits of establishing a cake-making business on your own but also a platform with a like-minded community. CakerHQ eliminates the majority of business hassles as a mediator between cake-makers and buyers, making the transformation from hobby to business seamless and enjoyable.